The Impact of Bitcoin Halving in 2028: A Comprehensive Insight

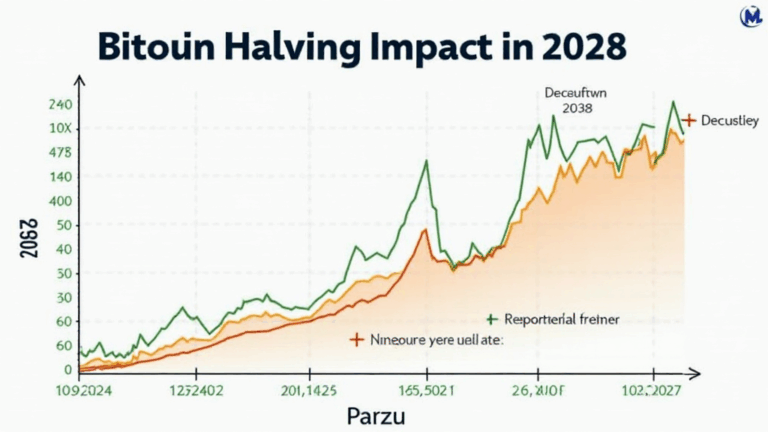

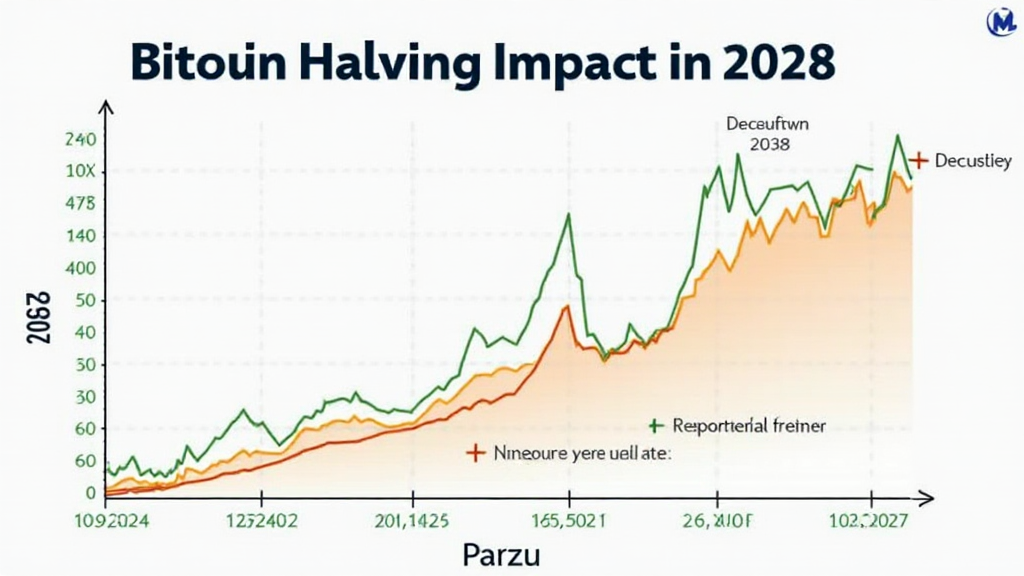

As we stand on the horizon of the next Bitcoin halving slated for 2028, one question looms large: what will be the impact of this event on the cryptocurrency landscape? With forecasts predicting a substantial increase in Bitcoin’s value, understanding the implications of the halving process becomes essential for anyone engaged in cryptocurrency investments or blockchain technology. To set the stage, let’s delve into some statistics: according to recent blockchain market research, Bitcoin proponents believe this halving could elevate Bitcoin’s market price from its current range significantly, possibly echoing the patterns of previous halvings.

A Brief Overview of Bitcoin Halving

The term “Bitcoin halving” refers to the scheduled event in which the reward miners receive for processing Bitcoin transactions is halved. This event occurs approximately every four years or every 210,000 blocks mined. It’s a critical mechanism designed to control the supply of Bitcoin, maintaining scarcity and, theoretically, supporting its value. In essence, it’s like having a bank where the interest rates keep being reduced periodically; fewer rewards could lead to an increase in a cryptocurrency’s valuation due to scarcity.

The Historical Context: Past Halvings

Bitcoin has undergone three halvings to date: in 2012, 2016, and 2020, each followed by significant price increases. For instance, following the 2016 halving, Bitcoin’s price surged from around $400 to nearly $3,000 in 2017. After the 2020 halving, the price climbed spectacularly from about $9,000 to an all-time high of nearly $64,000 in 2021. This pattern raises a pertinent question: will the 2028 halving continue the trend?

The 2028 Halving: Current Projections

Forecasting the outcome of the upcoming halving requires examining various factors including market conditions, technological advancements, and regulatory changes. Keep in mind that the unpredictable nature of cryptocurrency markets can lead to dramatic fluctuations, meaning investors should always conduct comprehensive research before making major decisions.

Here’s a projected timeline based on historical patterns:

ong>Market Sentiment: ong> According to a recent survey, 66% of cryptocurrency investors believe that the 2028 halving will lead to a bull market, akin to previous cycles.ong>Mining Difficulty: ong> The increased difficulty of mining could also impact market prices, as miners invest in better hardware and technology. This might squeeze the supply further.ong>Technological Advances: ong> Innovations such as the Lightning Network aiming to improve transaction efficiency could positively influence Bitcoin’s adoption and, consequently, its price.

Vietnam’s Position in the Crypto Space

As we analyze Bitcoin’s future, it’s important to consider emerging markets, particularly Vietnam, which is experiencing significant growth in cryptocurrency adoption. According to data, the Vietnamese crypto market has seen a user growth rate of over 35% in recent years. This enthusiasm can be attributed to several factors:

- The younger population, increasingly embracing digital currencies.

- Government initiatives aiming to control and upgrade blockchain technology regulations (tiêu chuẩn an ninh blockchain).

- Growing interest from local investors and businesses looking to capitalize on global crypto trends.

Future Implications for Vietnam’s Crypto Market

With Bitcoin’s potential price increase following the 2028 halving, Vietnamese investors might continue to seek out Bitcoin and other cryptocurrencies as viable investment opportunities. Reports indicate that regions like Ho Chi Minh City are becoming hubs for crypto-related businesses, further enhancing the ecosystem and attracting international players.

Investment Strategies Amidst Evolving Market Trends

For seasoned investors and newcomers alike, having a strategic approach during the lead-up to and following the 2028 halving is essential. Here are several strategies to consider:

ong>Dollar-Cost Averaging: ong> Investing a fixed amount regularly, regardless of market fluctuations, can help mitigate the risks associated with volatile price swings.ong>Diversification: ong> Rather than putting all funds into Bitcoin, consider a diversified portfolio that includes altcoins with potential growth, including those that align technologically.ong>Stay Informed: ong> Keeping abreast of market news and trends can provide insights that are critical for timely decision-making.

The Ripple Effect: Beyond Bitcoin

As Bitcoin undergoes its halving, the influence transcends the cryptocurrency itself. Markets for altcoins may rise with Bitcoin’s price, as seen in historical data. Traders often seek to ride the coattails of Bitcoin upward movements in price, and this demand can force altcoin values up significantly.

For instance, focusing on the potential of emerging altcoins, such as those with promising technology or backing, can yield strategic opportunities. For Vietnamese investors, tracking projects with local ties can provide a unique advantage, as local knowledge might exploit niche market potentials.

Historical Data and Future Projections

According to blockchain analytics firm Glassnode, past halving events typically see altcoin prices increase by 25-50% in the months following the halving date. Though historical trends do not guarantee future outcomes, they serve as significant indicators.

| Halving Year | Bitcoin Price Pre-Halving | Price Peak Post-Halving |

|---|---|---|

| 2012 | $12 | $1,150 |

| 2016 | $650 | $20,000 |

| 2020 | $9,000 | $64,000 |

As illustrated, even minor fluctuations leading into the halving can set the stage for explosive growth.

Conclusion: Preparing for the Future

As the 2028 Bitcoin halving approaches, its potential impact on both Bitcoin and the broader cryptocurrency market is increasingly becoming a topic of discussion. For those in the Vietnamese market, the trends indicate a likely increase in interest and investment in Bitcoin and other cryptocurrencies. As always, it’s essential to remain vigilant, monitor developments, and be adaptable to the changing landscape.

In summary, as we anticipate the aftereffects of this impending event, remember that strategic planning combined with informed decision-making can greatly enhance your investment journey in the cryptocurrency world. The 2028 Bitcoin halving is not just a scheduled event; it’s a pivotal moment that could redefine market dynamics for years to come.

Whether you are an experienced investor or a newbie, understanding these trends—not just Bitcoin’s potential price rise, but also its ripple effects across the crypto landscape—will be crucial to navigating the evolving market successfully. Keep your crypto strategies sharp and stay ahead of the curve!

Not financial advice. Consult local regulators. If you’re looking to engage in trading or investment, explore options at cryptoswapdex.

Dr. Turner has published over 15 papers on blockchain and cryptocurrency, and led audits for prominent projects in the industry, providing unique insights into future trends.