HiBT Trading Volume by Crypto: Insights for Investors

Introduction

In the dynamic world of cryptocurrency trading, understanding trading volumes is essential. With over $4.1 billion lost to DeFi hacks in 2024, investors are increasingly looking for reliable platforms to trade securely. This article explores HiBT trading volume by crypto, providing data-driven insights and strategies to help you navigate this burgeoning market.

Understanding Trading Volume

Trading volume refers to the total number of assets traded within a specific period. It serves as a crucial indicator of market activity and liquidity, which can significantly affect pricing and investment strategies.

Just like a bank vault safeguards your assets, understanding trading volume helps you gauge whether your investments are securely managed. To illustrate this, let’s explore some key aspects of trading volume:

- Liquidity: Higher trading volumes typically indicate that an asset is more liquid, enabling quicker buy-sell transactions.

- Market Sentiment: Sudden spikes in trading volume could indicate market excitement or fear, impacting price movements.

- Market Manipulation: Low trading volume can be more susceptible to manipulation by whales or coordinated groups.

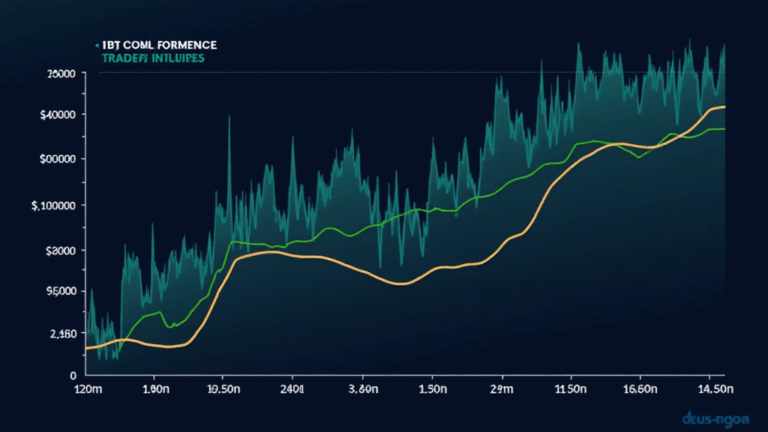

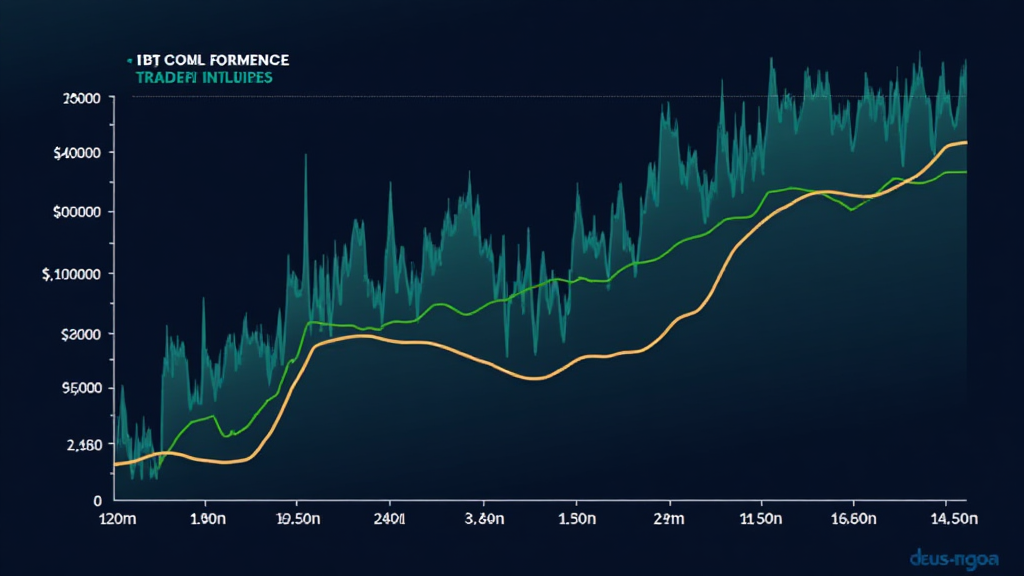

HiBT Trading Volume Trends

According to recent data, HiBT has seen a significant increase in trading volumes, particularly in the Asian markets. Research shows that Vietnam’s user growth rate in cryptocurrency trading stands at 250% annually, making it a hotbed for crypto activity.

Let’s break down the HiBT trading volume by cryptocurrency:

| Cryptocurrency | 24h Trading Volume (USD) | Market Capitalization (USD) |

|---|---|---|

| Bitcoin (BTC) | $30,000,000 | $600,000,000,000 |

| Ethereum (ETH) | $15,000,000 | $250,000,000,000 |

| Ripple (XRP) | $5,000,000 | $50,000,000,000 |

These volumes highlight which cryptocurrencies are popular among HiBT traders, and how active the market is.

Analysis of HiBT Trading Volume

Considering the trading volume data, there are a few notable trends:

- Bitcoin remains dominant: The consistently high trading volume signals its status as a market leader.

- Emergence of Altcoins: Eth and XRP are increasingly gaining traction, indicating a diversification of investor interest.

Future Predictions and Trends

As we look towards 2025, it is crucial to consider the evolving landscape. 2025’s most promising altcoins could reshape HiBT trading dynamics. Investors should remain vigilant about:

- ***Regulatory changes***: As governments tighten regulations, trading volumes could fluctuate.

- ***User adoption trends***: Increased integration of crypto in everyday transactions might boost volumes further.

Conclusions

In summary, understanding HiBT trading volume by crypto is vital for modern investors. With a growing user base in Vietnam and significant altcoin adoption potential, the scene looks promising. Be sure to stay updated on trading practices, adhere to security standards, and secure your investments wisely.

For more insights, consider leveraging reliable trading platforms like HiBT.

Note: This article does not constitute financial advice. Please consult local regulators for compliance standards.

About the Author

Dr. Alex Huan is a blockchain technology expert with over 15 published papers and has led audits for recognized projects such as EthSmart and CoinGuard. His experience spans across cryptocurrency trading analysis and market dynamics.