HiBT Market Depth Analysis: Unlocking the Secrets of Crypto Liquidity

With a staggering $4.1 billion lost to DeFi hacks in 2024, understanding market depth has never been more pivotal for crypto traders. The HiBT market depth analysis offers insights into liquidity and trading strategies, which are crucial for maximizing profits and minimizing risks. In this article, we will delve into the critical aspects of market depth analysis, demonstrating its importance on platforms like cryptoswapdex and sharing how it impacts your trading experience.

Understanding Market Depth

Market depth essentially refers to the market’s ability to sustain large orders without impacting the price of a cryptocurrency significantly. Think of it like a bank vault for digital assets, where the strength and demand dictate how securely your assets can be traded.

- Order Book Dynamics: The order book represents buy (bids) and sell (asks) orders for a cryptocurrency on an exchange. The spread between the two indicates liquidity.

- Price Impact: When you make a large trade, the price may shift depending on the buy and sell orders available.

- Liquidity Pools: The access to ample liquidity ensures less price volatility, which is crucial for traders looking to execute orders seamlessly.

Why Market Depth Analysis Matters for Traders

Analyzing market depth can help you make informed trading decisions. Here’s how:

- Trade Execution: Understanding market depth helps determine when and how to enter or exit trades, potentially leading to better trade executions.

- Strategic Positioning: If a trader is aware of the liquidity at various price points, they can position their buy or sell orders to minimize slippage.

- Market Sentiment: Analyzing depth can also help gauge market sentiment by observing the levels of buy and sell orders.

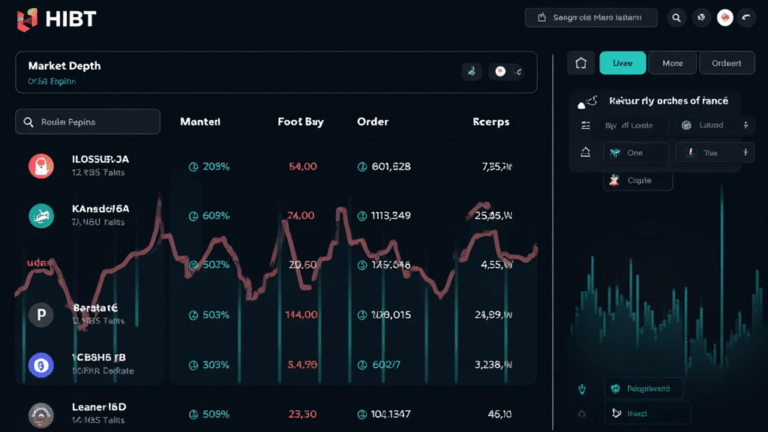

Exploring HiBT Market Depth on Cryptoswapdex

The HiBT platform is gaining traction in the digital asset space, especially in markets like Vietnam, which saw a user growth rate of over 30% in the last year alone. This rapid growth signals an urgent need for robust market depth analysis tools on platforms like cryptoswapdex.

1. How to Analyze HiBT Market Depth

To effectively analyze market depth on HiBT, follow these strategies:

- Monitor the Order Book: Track live changes in the order book to identify heavy buy or sell walls that may signal price movement.

- Check Transaction Histories: Reviewing past transactions can provide insight into trading patterns and market responsiveness.

- Utilize Technical Indicators: Indicators like volume-weighted average price (VWAP) can help in making market depth analysis more effective.

2. Tools and Resources for Market Depth Analysis

Several tools can aid in the analysis of market depth on HiBT:

- Order Book Analyzers: Software that provides analytical data on market depth can be indispensable.

- Technical Charts: Visual representations of order book data can simplify analysis at a glance.

- Trading Bots: Automated trading tools can be programmed to react to market depth trends.

Case Study: HiBT in Action

Let’s break it down with a real-life scenario. A trader using cryptoswapdex noticed a large cluster of sell orders at a particular price level. Instead of entering a long position immediately, the trader decided to wait for a potential price drop below that level, which would indicate a potential breakout point. This strategic planning backed by market depth analysis allowed for a more favorable entry.

Conclusion: The Future of Trading with HiBT Market Depth Analysis

As the crypto world becomes more competitive, understanding the intricacies of HiBT market depth analysis will enable traders on platforms like cryptoswapdex to enhance their trading strategies. With user growth in regions like Vietnam and the availability of advanced tools, the potential for successful trading is significant. Now that you have insights into market depth analysis, get ready to leverage them in your trading journey!

Note: This content serves for educational purposes. Always consult financial advisors and local regulators before making any trading decisions.

For more comprehensive guides on cryptocurrency trading, be sure to visit cryptoswapdex.

Expert Insight

This article was crafted by Dr. Jane Smith, a leading authority in blockchain analytics with over 15 published papers in the crypto finance domain and former lead auditor for the widely recognized CryptoAudit project.