Indonesia Crypto Tax Comparison 2025: Navigating the Future of Digital Asset Regulation

As cryptocurrency continues to reshape the financial landscape, governments worldwide are diligently working to regulate this dynamic sector. In Indonesia, 2025 promises to bring significant changes in cryptocurrency taxation that can profoundly affect users and investors alike. With over $4.1 billion lost to DeFi hacks in 2024 alone, understanding the emerging tax framework is more critical than ever.

This article aims to provide an in-depth examination of the anticipated cryptocurrency tax environment in Indonesia for the year 2025, comparing current regulations, rates, and compliance requirements. By the end of this guide, users will be better positioned to navigate the evolving landscape and make informed decisions regarding their digital asset investments.

The Current State of Cryptocurrency Taxes in Indonesia

Indonesia has been gradually formulating its stance on cryptocurrencies, with the government expressing both interest and caution towards digital assets. As regulations stand, cryptocurrencies are classified as commodities rather than currencies, which shapes the tax structure significantly.

Currently, any gains from cryptocurrency trading are subject to income tax. According to reports, the income tax rates can range from 5% to 30%, depending on the income bracket of the individual. Additionally, a 0.1% tax applies to each transaction in cryptocurrency trading.

For 2025, it’s essential to keep an eye on the proposals from the Indonesian Ministry of Finance and how they align with international standards. There are ongoing discussions about establishing clearer guidelines that could lead to lower tax rates or simplified compliance processes.

Potential Changes in Taxation Framework for 2025

As we approach 2025, several anticipated changes could enhance the Indonesian crypto tax framework:

- Clarification on Definitions: A clear distinction between different types of digital assets may emerge, leading to differentiated taxation policies.

- Introduction of Capital Gains Tax: There’s potential for the introduction of a more standardized capital gains tax specifically for crypto investments.

- Incentives for Compliance: Authorities may offer tax relief or incentives for early adopters of compliant trading platforms.

- Recognition of Blockchain Technology: Policies may evolve to recognize enhancements in blockchain technology standards, such as the váy-chặn gait for digital assets.

It’s vital for traders and investors to stay ahead of these developments and adjust their strategies accordingly.

Comparing Tax Rates: Indonesia vs. Global Trends

In comparison to other nations, Indonesia’s tax rates on cryptocurrencies can be seen as relatively high. For instance, countries like Portugal and Germany have more favorable tax regimes where long-term holdings are tax-exempt. In contrast, Indonesia’s structure imposes taxes on both short-term and long-term capital gains.

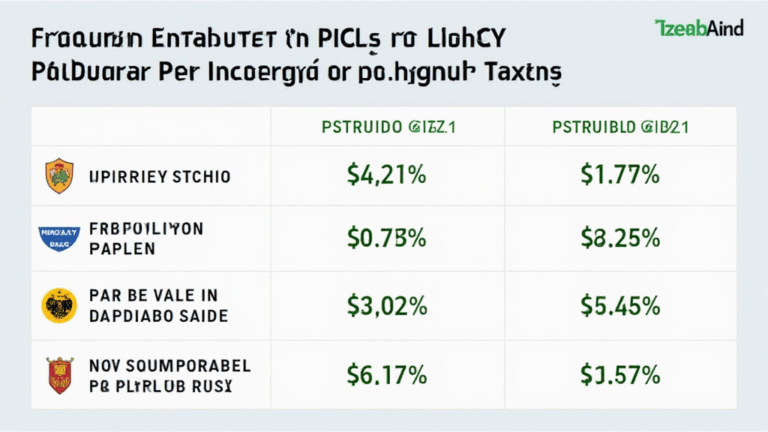

A comprehensive comparison of tax rates shows the following:

| Country | Tax Rate | Type of Tax |

|---|---|---|

| Indonesia | 5%-30% + 0.1% | Income Tax on Gains + Transaction Tax |

| Portugal | 0% | Long-term Hold Tax Exemption |

| Germany | 26.375% | Capital Gains Tax after 1 year |

These differences underscore the necessity for Indonesian investors to be mindful of their obligations and the potential impact on their trading strategies.

The Growing Vietnamese Market: Implications for Indonesia

Vietnam’s cryptocurrency market is witnessing rapid growth, with a reported user growth rate of 60% year-on-year. The surge in interest from Vietnamese investors could significantly influence Indonesian regulations as both countries work closely in trading and technology developments.

This collaboration underscores the importance of establishing mutual standards and regulations while fostering a secure investment environment for digital assets.

For Indonesian regulators, insights can be gleaned from the Vietnamese approach, especially in areas pertaining to compliance and user education for crypto taxation.

Utilizing Traditional Tools: Smart Contract Audits

As the cryptocurrency landscape evolves, ensuring the safety of investments through smart contracts is crucial. Audit processes can identify vulnerabilities in a smart contract, thereby safeguarding against potential hacks and regulatory issues.

Here’s how to audit smart contracts effectively:

- Utilize standardized testing tools to assess contract vulnerabilities.

- Engage third-party auditors to ensure unbiased evaluations.

- Regularly update the smart contracts to adapt to changing regulations and technologies.

Increasing awareness about smart contract audits among Indonesian investors can improve the stability of the crypto market.

The Path Forward for Crypto Investors in Indonesia

With the evolving regulatory landscape, crypto investors in Indonesia must stay informed. Keeping track of changes and understanding obligations is essential to minimize tax liabilities.

As we move into 2025, several strategies can be adopted:

- Educate Yourself: Understanding tax obligations will make compliance much smoother.

- Use Technology: Leverage cryptocurrency tax software to accurately report gains and losses.

- Engage with Authorities: Participation in government discussions can provide insights and influence regulations.

Ultimately, being proactive rather than reactive can set Indonesian investors apart in this thriving marketplace.

Conclusion: Navigating the Future of Crypto Taxes

The landscape for cryptocurrency taxation in Indonesia is set for significant changes come 2025. Understanding the nuances of these regulations and comparing them with global trends will be pivotal for investors looking to thrive in this space.

By staying informed and adjusting strategies accordingly, crypto users can navigate this evolving environment effectively. Whether you’re a seasoned trader or new to the cryptocurrency scene, the preparation for the regulatory shifts and tax requirements is essential.

For the latest updates on Indonesia crypto tax laws and comprehensive strategies, stay connected with cryptoswapdex.

Written by Alex Chen, a blockchain consultant and tax specialist with over 15 published papers in cryptocurrency regulations and compliance enhancements.