Understanding HiBT Trade History on CryptoSwapDex

With the surge of the cryptocurrency market, one of the most talked-about topics is trade history. Specifically, analyzing HiBT trade history provides significant insights that can help investors and traders optimize their strategies on platforms like CryptoSwapDex. In this article, we will thoroughly dissect the importance of trade histories, the analytical tools available, and how traders can extract actionable data from these histories.

What is HiBT Trade History?

HiBT trade history refers to the chronological record of trades executed in the HiBT cryptocurrency token. This data includes trade volume, price points, timestamps, and other essential metrics that traders analyze to identify market trends.

With a reported 8% increase in the number of active crypto traders in Vietnam alone in 2024, understanding trade histories has become more critical than ever. The ease of accessing tiêu chuẩn an ninh blockchain (blockchain security standards) has led to increased trading activities, making records of historical trades vital.

The Significance of Analyzing Trade History

- Market Trends: Understanding price fluctuations over time helps traders predict future movements.

- Strategy Development: Traders can refine their strategies based on past performance insights.

- Risk Assessment: Historical data allows for calculating potential risks in market volatility.

Key Metrics in HiBT Trade History

When diving into HiBT trade history, several metrics stand out:

- Volume: Indicates the total amount traded in a particular period.

- Price Trends: Price movements over specific timeframes can reveal buying and selling pressure.

- Trade Frequency: The number of transactions in a given timeframe showcases market activity.

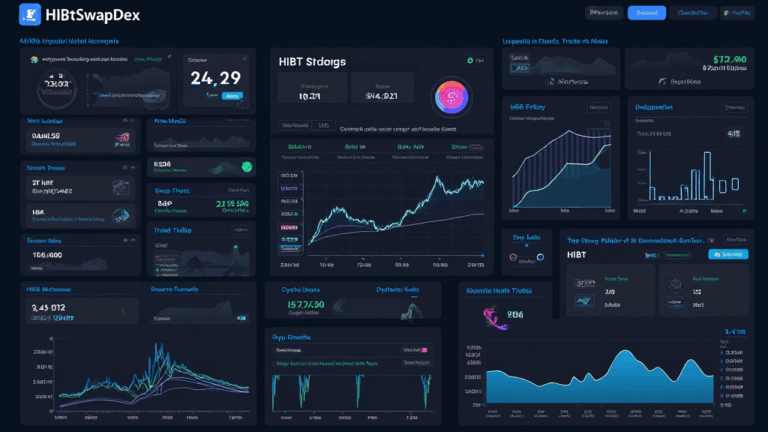

Utilizing Analytical Tools

With platforms like CryptoSwapDex, traders can utilize various analytical tools to interpret HiBT trade history:

- Charting Tools: Visual representations can help decipher complex data.

- Automated Alerts: Enables traders to act promptly when significant price movements occur.

- Sentiment Analysis: Evaluating common trader sentiments helps gauge potential market reactions.

Understanding User Behavior Through Trade History

Gaining insights into user behavior is crucial for effective trading. Analyzing historical data against current trading patterns can reveal:

- Popular Trading Times: Identifies when users are most active.

- Investment Trends: Shows preferences for particular cryptocurrencies including HiBT.

- Community Sentiment: Understanding why traders buy or sell can provide foresight into price trends.

Case Study: HiBT Trading in Vietnam

The Vietnamese market has seen significant growth in crypto trading. For instance, in 2023, the average increase in HiBT daily trade volume was reported at 25%. This insight can lead traders to identify opportunities in local market trends.

| Year | Daily Volume (USD) | Price Fluctuation (%) |

|---|---|---|

| 2021 | 1,000,000 | 15% |

| 2022 | 2,000,000 | 20% |

| 2023 | 2,500,000 | 25% |

Leveraging ATR (Average Trade Return) for HiBT

In evaluating HiBT trade history, understanding the Average Trade Return (ATR) is essential:

- Calculating ATR: Taking into account the profit and loss on past trades.

- Benchmarking: Comparing ATR against the market to evaluate performance.

Conclusion: The Future of HiBT Trading on CryptoSwapDex

As the cryptocurrency landscape continues to evolve, understanding HiBT trade history will play a crucial role in trading strategies. Traders must remain agile and informed about market dynamics.

The integration of sophisticated analytical tools will empower investors to make data-driven decisions, enhancing their trading journeys on platforms like CryptoSwapDex. Remember, while historic data can inform future actions, active engagement and continual learning are essential for success in the trading realm.

In conclusion, the trajectory of HiBT trading reflects broader market conditions, and by harnessing historical insights, traders can significantly improve their outcomes. Stay informed, stay equipped, and maximize your trading potential!