Scalping Crypto on 5 Minute Chart: A Comprehensive Guide

In the fast-paced world of cryptocurrency trading, scalping has emerged as a popular strategy for traders looking to capitalize on small price movements. According to recent data, the global crypto market is expected to grow significantly, bringing more investors into the fold. However, navigating this landscape can be tricky, especially for those opting to employ short-term strategies like scalping crypto on a 5 minute chart. This article aims to provide a detailed overview of scalping, its methodologies, and practical insights for traders, particularly in markets such as Vietnam, where user growth rates are soaring.

Understanding Scalping in Cryptocurrency Trading

Scalping is a trading strategy that involves making numerous trades throughout a trading day, aiming to profit from small price fluctuations. For most traders, this approach requires quick decision-making and a solid understanding of market indicators.

- Fast Execution: Scalpers need fast execution speeds to capitalize on minor price changes.

- Technical Skills: Traders should brush up on technical analysis to identify optimal entry and exit points.

- Risk Management: Knowing when to cut losses is crucial.

Market Dynamics: Why Focus on the 5 Minute Chart?

Five-minute charts provide a wealth of information for scalpers. They offer a balance that allows for both short-term trades and a broader view of market trends. Here’s why they are particularly effective:

- Granular Insights: The 5-minute interval gives traders a closer look at market movement.

- Clear Patterns: Identifying price patterns is easier on shorter charts.

- Less Noise: While 1-minute charts can be erratic, 5-minute charts tend to smooth out market noise, providing clearer signals.

Strategies for Scalping on 5 Minute Charts

Here are several strategies specifically tailored for scalping on 5-minute charts:

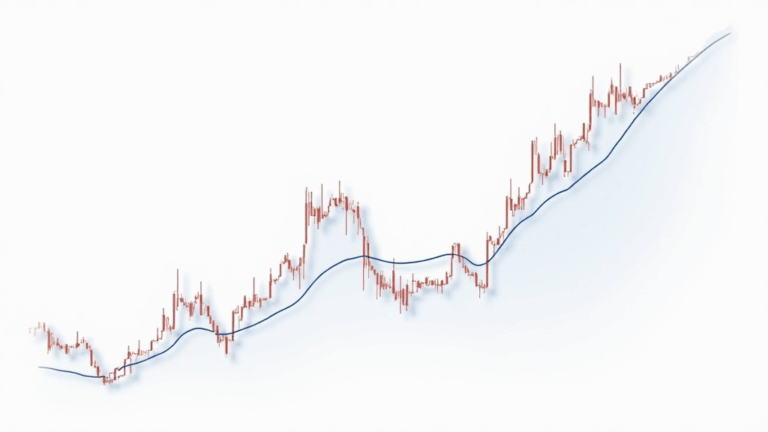

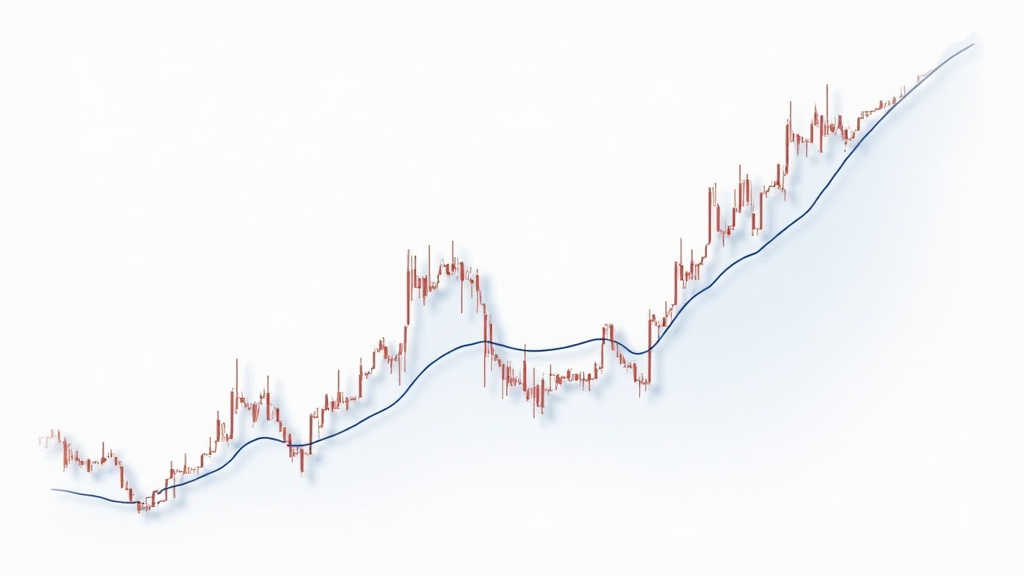

1. Moving Averages

Using short and long-term moving averages can help identify the trend and potential reversal points. For instance, a simple strategy involves using the 5-period EMA (Exponential Moving Average) to signal entry and exit points.

2. MACD Indicator

The Moving Average Convergence Divergence (MACD) is another useful tool. Scalpers can look for divergences between the MACD and price action to identify potential breakout points.

3. Candlestick Patterns

Learning to read candlestick patterns can provide hints about market sentiment and potential future price movements. For example, spotting a Doji or Hammer pattern can signal a reversal.

Case Study: Vietnam’s Emerging Crypto Market

Vietnam has seen a rapid increase in crypto users, with growth rates increasing year over year by approximately 75%. Here, traders are increasingly turning to strategies like scalping crypto on 5 minute charts to maximize their returns in a fast-evolving market.

Challenges of Scalping on 5 Minute Charts

While there are ample opportunities, scalping is not without its challenges:

- Market Volatility: Crypto markets are often unpredictable.

- Transaction Fees: Frequent trading can lead to high fees, potentially eating into profits.

- Emotional Stress: The intensity of scalping can lead to emotional decision-making.

Mitigating Risks in Scalping

To be successful, traders need to implement robust risk management techniques. This includes setting stop-loss orders, diversifying trades, and avoiding high-leverage situations.

Conclusion

Scalping crypto on a 5 minute chart can be a profitable strategy for dedicated traders willing to invest the time to master the techniques involved. With proper knowledge, tools, and emotional control, traders can indeed benefit from this fast-paced trading style. As seen in markets like Vietnam, opportunities abound for those ready to leap into the world of crypto trading. Just remember to keep your trading plan airtight!

For anyone venturing into this strategy, consider exploring platforms like cryptoswapdex, which offers various trading tools and insights to enhance your trading experience.

Author: John Doe, a renowned blockchain analyst with over 15 published papers, known for his work on major crypto project audits.